CASE STUDIES

HOW BUSINESSES LIKE YOU ARE BEING SUPPORTED

AN EXPOSED AND UNSURE BUSINESS OWNER (SUMMER 2024)

I had a client referred to me by their accountant because the business owner had reached out to say he didn’t feel they knew their numbers well enough and felt exposed when talking to the accountant and management team. Firstly we talked about the issues and then I looked at their bookkeeping system.

One of the first areas I investigate is bank reconciliation to see if the bookkeeping system is being reconciled to the bank statements in a timely manner. This is important as the bank is an outside authority which will almost certainly be correct. If the bank balance does not reconcile to the amount in the accounting records, I know there is likely to be an error or omission somewhere.

In this instance I then looked at their balance sheets, and in particular their Trade Debtors and Creditors. Here it was easy for me see if the amounts owed to and from the business were being controlled effectively. It was also possible for me to tell if the company was at risk of over-reliance on one or two debtors or one large creditor. Fortunately in this case, the bookkeeping looked well controlled and the bank, debtors and creditors where all in order. So far so good!

The next thing was to look at their statutory accounts and compare them with their bookkeeping records. Here an immediate problem was evident. It was very difficult to understand how they tied together. Unfortunately the financial information they were looking at on a weekly and monthly basis did not match the accounts as presented by the accountant. It was no wonder that the business owner felt exposed and unsure!

Digging deeper, it was soon realised that the cost of the wages (which in the client’s case was substantial as he was a service business), was not being fully shown on the Profit and Loss Account and was instead sitting in the Balance Sheet. This meant that the profit during the year was overstated and this was not picked up until the accountant prepared the statutory accounts.

Regrettably, their accountant either did not explain this bookkeeping error to the business, or the communication failed to land, and this was not fixed until I came along with a deep dive into their finances and bookkeeping review.

A simple recurring system has now been set up so the actual figures and the profit for the business are shown correctly every month. Any uncertainties or errors will now be quickly picked up and corrected.

Now that I am overseeing the accounts and talking to the business owner every month, we have a much better understanding of the financial situation of the business, the accountant is happy as they have a more informed client and can have informed conversations about strategy and tax planning , and the client is happy because they know their business a lot better.

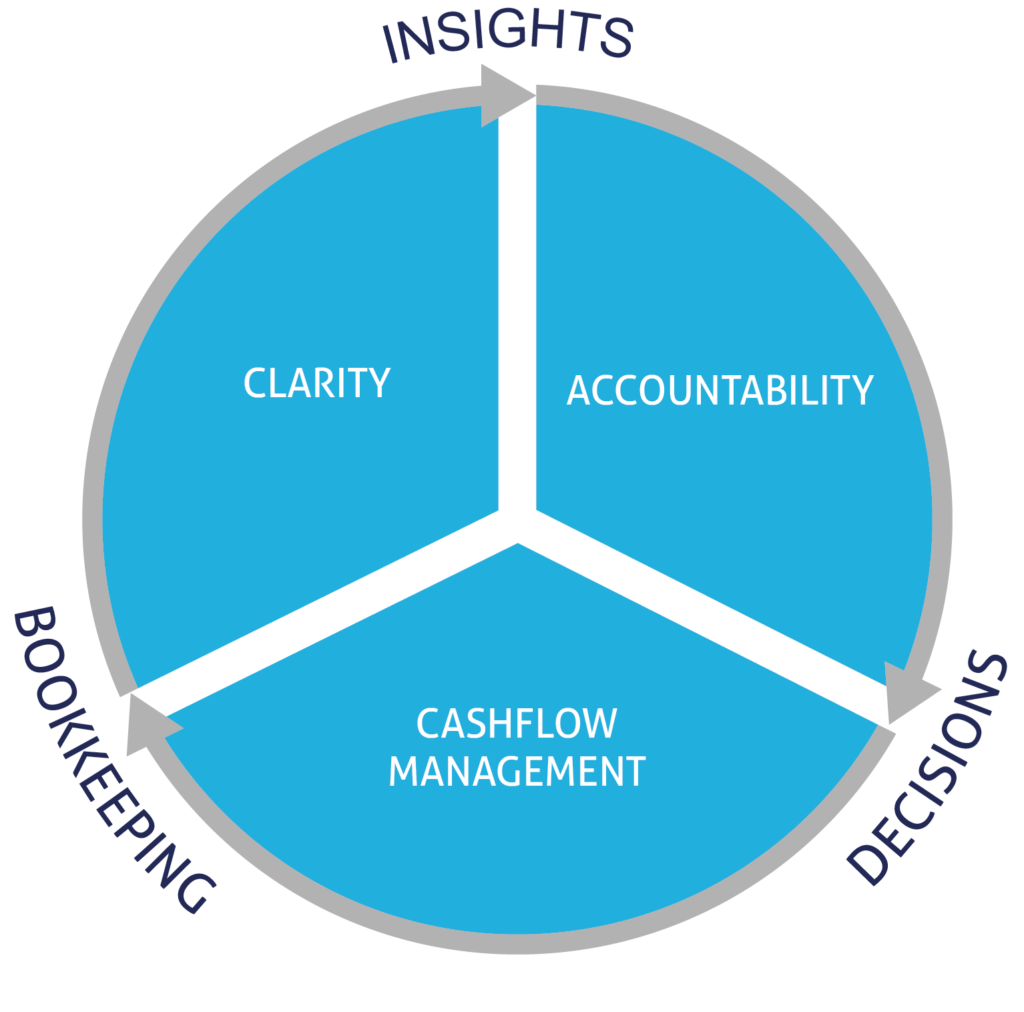

Blue Dragonfly Insights will teach you to speak the same language as your bookkeeper or accountant so you can take control and avoid sleepless nights over cash flow in order to:

- Avoid running out of cash

- Gain clarity on your business performance

- Know how to improve your business

- Learn what your business is worth

- Increase your business finance confidence

Hi I’m Angela, BDI founder, chartered accountant and business coach.

I’ve been supporting business owners for many years by helping them

get to grips with their finance software and their reports enabling them to make their business planning decisions based on accurate accounting.

HOW TO WORK WITH ME

- Free Bookkeeping Review

- Restoration and Repair

- Training

- Leading Indicators Selection

- Report Generation

- Cashflow Templates

- Monthly Insight meetings

- Quarterly Check up

- Quarterly Planning

The first step is to arrange your FREE Bookkeeping Review by emailing me at: angela@bluedragonflyinsights.co.uk or attend on of my finance events.

REVIEWS